companies house late filing penalties pay

The company must deliver acceptable accounts by 30 June 2020 to avoid a late filing penalty. Youll automatically receive a penalty notice if your accounts are filed after the deadline.

How To Avoid A Late Filing Penalty Companies House

5 of tax due.

. Pay late filing p enalty by instalment is possible to arrange if your company is unable to pay the late filing penalty outright. To sign in to or. Use this service to pay a companys late filing penalty. If you miss a filing or payment deadline set by Her Majestys Revenue Customs HMRC or Companies House youll face immediate penalties and fines which escalate over time.

Added the online service to appeal a late filing penalty. The punishment is mult. Do I have to pay Companies House late filing penalty if I close the Limited Company. A late filing penalty notice will be issued after your accounts have been filed late.

Late filing penalty appeals are to be treated sympathetically in instances where the late delivery of accounts has been a result of the coronavirus pandemic. Whats more you will be charged 3 interest on any overdue taxes in addition to those charges until your bill is fully paid. We wanted to build something to let them easily. Thereafter you have to send the cheque to the correct Companies House offices.

If you do not apply for an extension before your filing deadline and your accounts have been filed late an automatic penalty will be imposed. HM Revenue and Customs HMRC will estimate your Corporation Tax bill and add a penalty of 10 the unpaid tax. Write to Companies House with your proposed late filing penalty instalment payment plan. Updated BACS details with new Companies House bank account.

You must explain why you unable to pay the late. Companies House annual accounts late filing penalties. I have just got a penalty letter in from them for 1500 for late filing of the 2019 accounts. Companies House has issued the following updated guidance.

It usually takes up to 3 working days for your payment to reach Companies House. The penalty is doubled if your accounts are late 2 years in a. Free company information from Companies House including registered office address filing history accounts annual return officers charges business activity Cookies on Companies House services We use some essential cookies to make our services work. Time since the deadline.

You can pay companies house penalties by cheque bank transfer known as BACS or by creditdebit card. 5 of tax due at that date. Punishments for late documenting. Youll find your company number on your penalty notice.

The reference number on the penalty notice. Weve got the information you need to help you make sense of the main returns you need to submit and the financial consequences if you dont. The date your accounts were filed. You should make it payable to companies house late filing penalties with your company name and number on the reverse of the cheque.

The penalty doubles if you miss the deadline two years in a row. You can pay the penalty by BACS by clearly stating the company number on the bank transfer and using it as the. 5 of tax due at that date. My small company has never trade.

If your tax return is late 3 times in a row the 100 penalties are increased to 500 each. This should be returned to us with the remittance slip. Companies House has updated its Covid-19 guidance and has ended payment breaks for late filing penalties. The last date for filing.

How to pay company house penalties. Late filing of accounts and confirmation statements. 1 month after the deadline. Another 10 of any unpaid tax.

Firstly if you are to pay for the penalty by cheque please write the cheque payable to Companies House. UK registered private companies public companies and limited liability partnerships LLP will once again be given an automatic penalty if they file their accounts after the deadline. The penalty notice will give details of. Late filing penalties.

Universally your company may pay your late filing penalty by a number of methods acceptable with Companies House. Pay penalty by installment. You can pay using Bacs payment. The penalties for late filing are between 150 and 1500 depending on how late they are.

The penalties for late payment are. Conciseaccountancy May 24th 2019 company accounts. Paying your LFP by BACS only. Companies House Late Filing Penalties are back.

If they were not delivered to Companies House until 15 July 2020 the company would get a 150 penalty. In the event of an unsuccessful appeal a break is to be provided to companies in order to pay any. In reality the likelihood is that Companies House will give up pursuing the late filing penalty but to get a 325 fine youre looking at a long overdue set of accounts not the 31 July 2020 as noted for which you will have received a few reminders and then a notification or two that a penalty would be levied once late. However the circumstance is.

Companies that fail to meet these deadlines must pay the penalties detailed below. Pay late filing penalty by Cheque. For example for companies. The level of the penalty imposed.

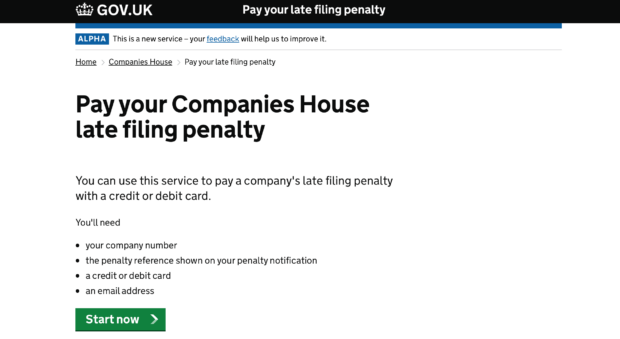

Companies House has their own set of deadlines for filing of annual accounts. Youll need to pay punishments if you dont file your accounts with Companies House by the due date. At the moment people can only pay their late filing penalties by phone or sending a cheque.

How To Avoid A Late Filing Penalty Companies House

Service Assessment Paying Late Filing Penalties Online Companies House

Late Filing Penalties Appeals Pdf Free Download

Posting Komentar untuk "companies house late filing penalties pay"